On January 1, 2015, Smith Company acquired 80,000 shares of Bonn

Logistics, Inc. for $32 per share. This gave Smith a 35 percent

ownership of Bonn and Smith utilized the equity method to account

for this acquisition.

As of the date of acquisition, Bonn had assets with a book value of $7,200,000 and liabilities of $1,750,000. Equipment held by Bonn appraised at $50,000 above book value and was considered to have a 10-year remaining life. In addition, Bonn’s building was appraised for $1,300,000, but had a book value of $800,000 with a 20-year remaining life. Any remaining excess cost was attributable to goodwill. Depreciation and amortization utilizes the straight-line method.

Income and dividends for the years ended December 31, 2015, 2016, and 2017, are as follows, respectively: Income = $185,000, $275,000, $340,000; Dividends = $32,000, $45,000, $62,000.

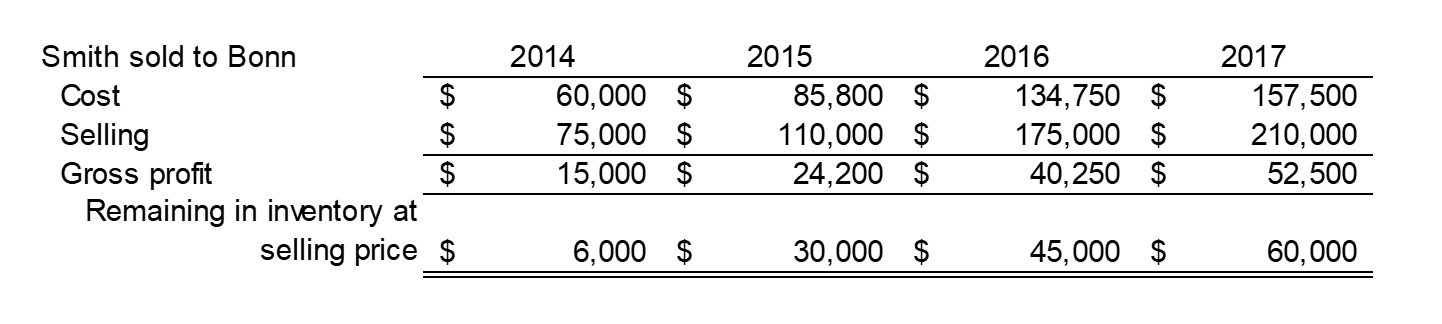

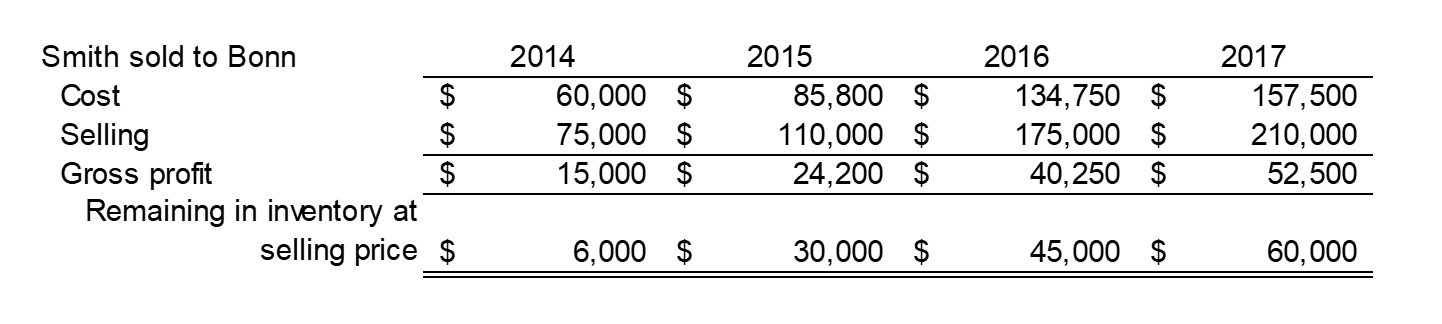

In addition, Smith sold inventory to Bonn beginning in 2014 and continuing through the year-end date of December 31, 2017. The detail of the transactions and the amount remaining in inventory for Smith at the end of each year is as follows:

Required:

As of the date of acquisition, Bonn had assets with a book value of $7,200,000 and liabilities of $1,750,000. Equipment held by Bonn appraised at $50,000 above book value and was considered to have a 10-year remaining life. In addition, Bonn’s building was appraised for $1,300,000, but had a book value of $800,000 with a 20-year remaining life. Any remaining excess cost was attributable to goodwill. Depreciation and amortization utilizes the straight-line method.

Income and dividends for the years ended December 31, 2015, 2016, and 2017, are as follows, respectively: Income = $185,000, $275,000, $340,000; Dividends = $32,000, $45,000, $62,000.

In addition, Smith sold inventory to Bonn beginning in 2014 and continuing through the year-end date of December 31, 2017. The detail of the transactions and the amount remaining in inventory for Smith at the end of each year is as follows:

Required:

- Prepare a schedule that identifies the allocation of the investment amount by Smith in the acquisition of Bonn. Make sure to identify the individual steps / parts a you develop and display the solution.

- Develop a schedule to illustrate the amount of excess amortization associated with the undervalued assets.

- Prepare a schedule to support any profit in inventory deferral or recognition for each of the three years.

- Prepare a schedule computing the equity income to be recognized by Smith during 2015, 2016, and 2017.

- Prepare a schedule that tracks the amount in the Investment in Bonn account on the books of Smith for each of the three years ending December 31, 2017.