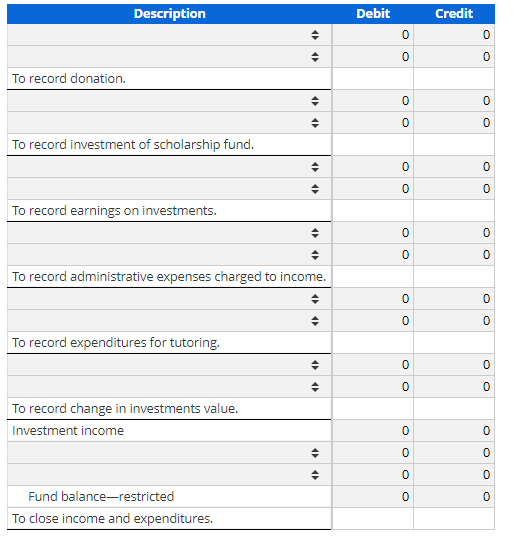

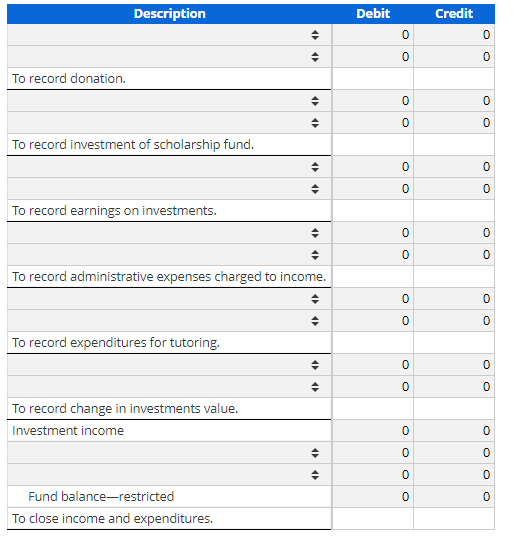

At the start of 2020, a resident of the City of LaVerada donated

$2.5 million to the LaVerada School District. The donor specified

that the entire $2.5 million be invested, and investment income

used to provide tutoringservices for high school students.

Investments were made, and 2020 investment income was $100,000.

Administrative costs related to investing activities were $2,000.

The school district started a tutoring program, and spent $15,000

for supplies, $25,000 for facilities rent, and $35,000 for

tutoring. The investments are worth $2,580,000 at the end of

2020.

Required

The drop down options are as follows: Cash-principal, Fund balance-nonspendable, Investments-principal, Cash-income, Investment income, Investments-income, Expenditures, Unrealized gain on investment, Unrealized loss on investment.

Record the events described above in a permanent fund. Include closing entries.

Required

The drop down options are as follows: Cash-principal, Fund balance-nonspendable, Investments-principal, Cash-income, Investment income, Investments-income, Expenditures, Unrealized gain on investment, Unrealized loss on investment.

Record the events described above in a permanent fund. Include closing entries.