| OLSON SPORTS, INC. | |||||||

| Adjusted Trial Balance | |||||||

| December 31, 2020 | |||||||

| (prepared by Becky Olson) | |||||||

| ($ in thousands) | Debit | Credit | |||||

| Cash | $ | 570 | |||||

| Accounts receivable | 373 | ||||||

| Allowance for doubtful accounts | $ | 18 | |||||

| Inventories | 539 | ||||||

| Prepaid expenses | 59 | ||||||

| Land | 22 | ||||||

| Building | 189 | ||||||

| Equipment (furniture, fixtures, and computers) | 360 | ||||||

| Accumulated depreciation | 222 | ||||||

| Software | 90 | ||||||

| Patents | 1 | ||||||

| Goodwill | 161 | ||||||

| Accounts payable | 252 | ||||||

| Accrued liabilities | 182 | ||||||

| Income taxes payable | 16 | ||||||

| Long-term debt | 49 | ||||||

| Common stock | 3 | ||||||

| Additional paid-in capital | 243 | ||||||

| Retained earnings | 1,107 | ||||||

| Sales revenue | 2,487 | ||||||

| Credit card discounts | 53 | ||||||

| Cost of sales | 1,306 | ||||||

| Advertising expense | 145 | ||||||

| Utilities expense | 85 | ||||||

| Wages expense | 625 | ||||||

| Interest expense | 1 | ||||||

| Totals | $ | 4,579 | $ | 4,579 | |||

- On the last day of the year, failed to record the $100 sale of hiking merchandise to a customer who paid with his Visa credit card. Visa charges Olson Sports a 3 percent fee.

- On December 31, failed to write off a $3 bad debt.

- Failed to record bad debt expense for the year. After the write-off in (b), based on an aging of the accounts receivable, Olson Sports calculated that $21 will likely be uncollectible.

- The auditor noted that the inventory is listed on the trial balance at current cost using the first-in, first-out method. However, it should be measured using the last-in, first-out method. Beginning inventory was 15 units at $10 per unit, the April 10 purchase was 40 units at $11 per unit, the July 2 purchase was 52 units at $13 per unit, and the October 4 purchase was 28 units at $16 per unit. The count of inventory on hand at the end of the year was 35 units.

- Failed to record $10 in new store fixtures (equipment) that arrived at Olson Sports’s shipping dock during the last week of the year, with payment due to the manufacturer within 30 days. Olson Sports paid $1 cash for delivery and $3 to install the new fixtures.

- On December 31, failed to record the sale of old computers (equipment) with a cost of $20 and a net book value of $8 for $3 cash. When they were sold, no depreciation had been recorded for the year. Olson Sports depreciates computer equipment using the straight-line method with a residual value of $4 over a four-year useful life. [Hint: Prepare two entries.]

- Failed to amortize the accounting software that Olson Sports purchased at the beginning of the year. It is estimated to have a three-year useful life with no residual value. The company does not use a contra-account.

- Failed to record the annual depreciation for the building and furniture (equipment):

- The building is depreciated using the straight-line method with a residual value of $9 over a 20-year useful life.

- Furniture costing $120 is depreciated using the double-declining-balance method with a residual value of $20 over a 10-year useful life. The accumulated depreciation of the furniture at the beginning of the year was $60.

- Failed to record income tax expense for the year. Including the effects of the above entries, record Olson Sports’s income tax expense at an effective rate of 24 percent.

1- Record the $100 sale of hiking merchandise to a customer along with a 3% fee charged by Visa for credit card payment.

2- Record the write off a $3 bad debt.

3 – Record bad debt expense for the year based on an aging of the accounts receivable.

4- Record the cost of sales resulting from a change in the method of valuing current cost of inventory for FIFO to LIFO.

5 – Record the purchase of $10 in new story fixtures (equipment), $1 paid for its delivery and $3 for its installation.

6 – Record the depreciation on sale of old computers (equipment) with a cost of $20 and a net book value of $8 for $3 cash.

7 – Record the loss on sale of old computers (equipment) sold for $3 cash.

8 – Record the amortization of accounting software.

9 – Record the annual depreciation for the building and furniture

10 – Record the income Tax expense for the year.

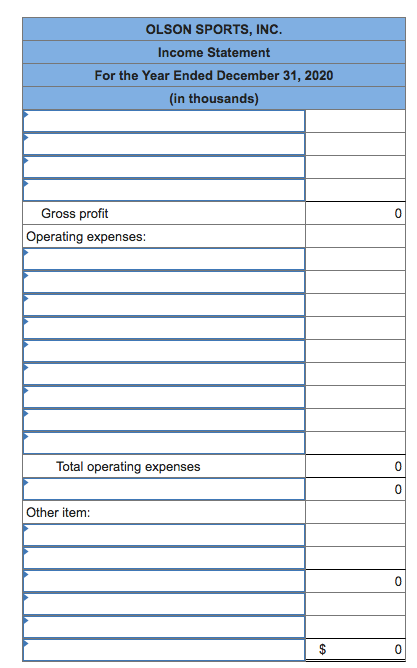

Prepare Income Statement